AS THE SCHOOL year begins and you realize your savings from your summer job won’t last forever, you might come to the conclusion that you’ll be broke for most of the year. But the Fulcrum’s here to keep you from resorting to eating to Kraft Dinner or Mr. Noodles to save money, and we’ll help you get more out of your dollar. Student saving isn’t always fun, but you’re sure to stretch your funds further if you plan ahead!

Living Expenses

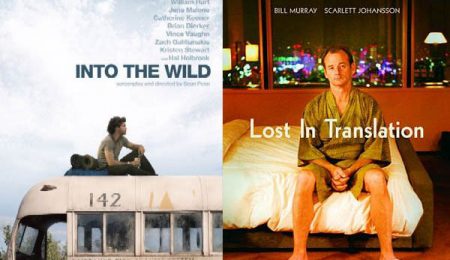

Finding an affordable place to live that doesn’t smell like last year’s leftovers can be tough. If you’re financing your own apartment, don’t live on campus. Get a place in Sandy Hill and find as many roommates as you can. Bundle your utilities with your roommates to save more money. Get a student price on Internet, and forgo a home phone if you already have a cell. Reconsider getting cable television; most shows are online anyhow—check out channels like GlobalTV and CTV, that post their series online.

Necessities

When it comes to getting the goods, remember: Everything is more expensive downtown. Make good use of your U-Pass and shop for groceries farther down the Transitway. Before you go out, check out store flyers online to see if you can coordinate a cheap meal with what’s already in your pantry. Another thing to remember is things are usually cheaper in bulk. Bring friends shopping with you so when you see a “buy six, get six free” deal, you take advantage of it.

Never shop hungry or after just receiving a paycheque—you’ll be more likely to spend on impulse, making your bill skyrocket. Make a list of things you need before you leave the house so that you’re not wasting money on food that won’t get eaten. Leave the credit card at home and spend the money you actually have—interest charges can add up after a while.

Vices

Give up cigarettes, coffee, or alcohol—it’ll be good for your body, as well as your wallet. If you want to go out for a few (or more) drinks with friends, get a couple of shots in before the big night. Buy your alcohol in Quebec—where it’s much cheaper—and have a pre-drinking party. You’ll save money at the bar without compromising your blood-alcohol level.

Tuition and school fees

Go for the gold—or at least the scholarship. If you’re paying for your own schooling, take the time to apply for every scholarship you can find. There are a lot of incredibly specific, unknown scholarships out there. Even if you don’t meet all the requirements for one, go for it. For all you know, you could be the only applicant.

When your professor tells you the textbook will cost $200, don’t panic. There’s no need to head straight for the book store to get a brand new copy. Check the local classifieds, like Kijiji or UsedOttawa, and pay attention to the bulletin boards around campus—used copies are always cheaper. If you don’t find anyone selling the book you need, check the libraries around town. The one on campus sometimes has textbooks on reserve, so does the Ottawa Public Library. If all else fails, make a friend in the class and split the cost with them.

Overall, monitor your spending. If your bank offers financial advice for students, see what they have to say. Living on your own and trying to balance school and work can be tough. Have some money saved for those tough days and keep your head high when you are in a tight situation. Just think: When you’re out of university, you’ll be rolling in the dough.

—Jane Lytvynenko